It's crucial to shop around for the best home insurance rates that suit your needs. Home insurance rates in Arkansas are affected by several factors. This includes your home's value, size, location and claims history. To compare coverage and rates, you can get quotes from multiple insurance companies.

Shelter ranked as the best home insurance company in Arkansas

Shelter provides the best rates for homeowners. It is due to Shelter's strong financial standing and excellent customer service. It also offers a wide range of protections, including reimbursement for fire department charges, property damage protection and credit card fraud.

Liberty Mutual ranks second in Arkansas for home insurance prices

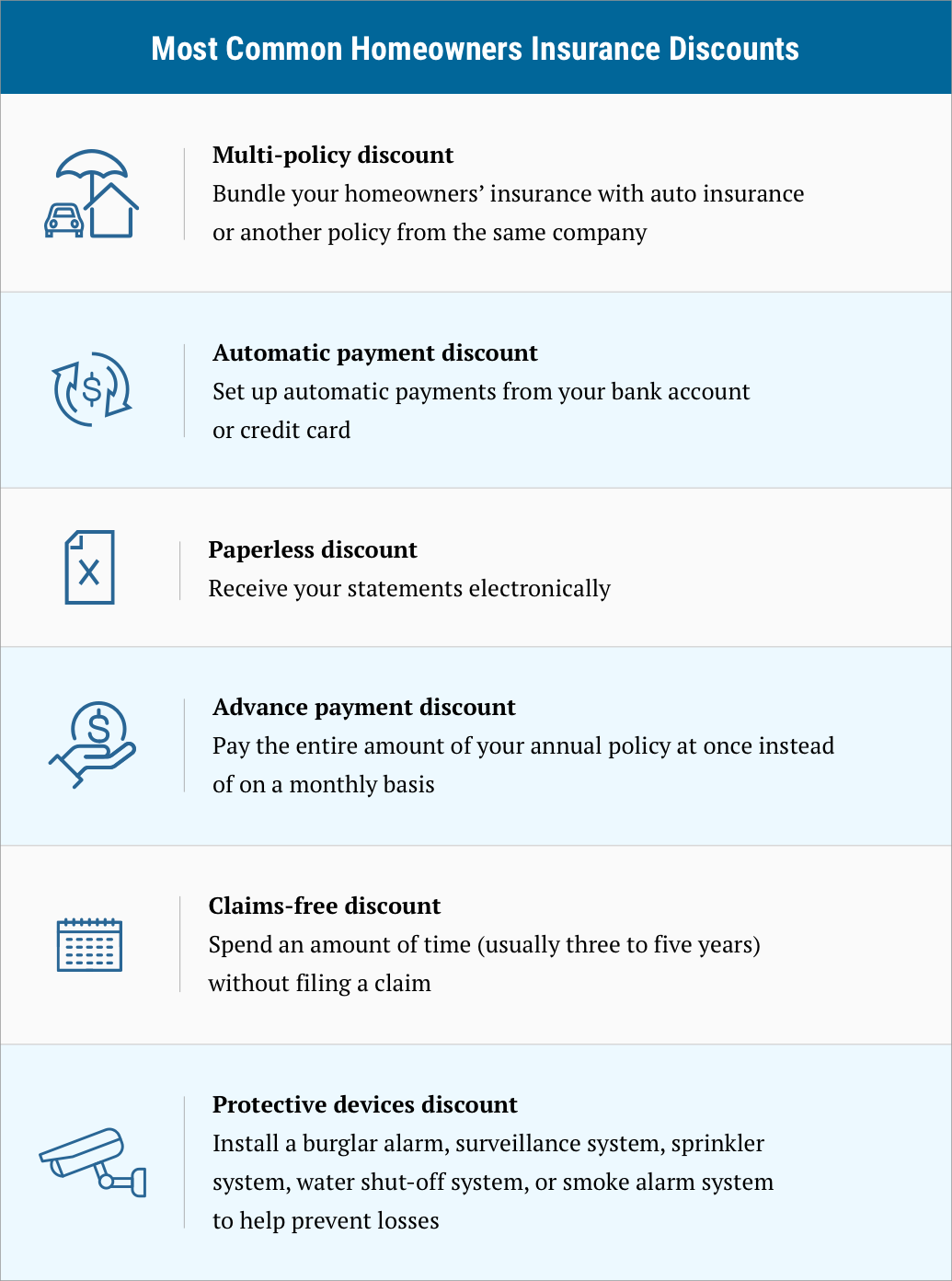

When you choose Liberty Mutual, you can take advantage of its many discount opportunities, including discounts for low-risk occupations, good driving records and discounts for completing safety courses. For example, the company offers discounts when you install security devices like burglar alarms or motion-activated light bulbs to lower your insurance rate.

Chubb is ranked seventh in the nation for cheapest homeowners insurance in Arkansas

Consider a Chubb policy if you want your home to be protected. The provider offers a number of additional features, such as dwelling extended replacement cost, which pays to rebuild your home, even if it costs more than the policy's limit. The policy allows you to add additional coverages such as identity theft protection, computer and inflation protection.

Allstate Ranks Third for cheapest home insurance in arkansas

Bundling auto and homeowners insurance can save you money. Allstate, for example, offers a 25% discount on your policy if you bundle auto and homeowners policies.

If you've made recent insurance changes like upgrading your roof or adding new items, you may also be eligible for a complimentary on-your side review. This can lower your premium and help protect your biggest asset.

USAA Ranks Fourth for cheapest home insurance in arkansas

If you choose to insure your home through USAA, you'll receive many benefits including On Your side(r) Reviews and 24/7 customer support. It also offers unmatched military benefits and services.

Travelers Ranks Fifth in Arkansas for Cheapest Home Insurance

Arkansas homeowners' insurance is priced at $2,890 on average per year. That's slightly higher than the national average, but it doesn't mean it's impossible to find affordable coverage in the state. In fact, you can often find low-cost home insurance quotes online.

The deductible is what you pay upfront before your insurer pays for losses. Most home insurers offer a standard deductible, which can be anywhere from $100 to $500.

You can reduce your deductible by paying your premium on time or not filing any claims. By insuring a home with a credit score of 750 or higher, you will be able to avoid higher deductibles.

You can get a quote for home insurance to find out if you're getting the best deal. Each insurance company uses its own pricing model and underwriting criteria.