Many factors determine your auto insurance premium, including driving history and credit ratings. To find the lowest rates, it's best to shop around. You may be able to get a lower premium by looking into discounts.

Missouri auto insurance is mandatory and protects you in case of an accident. The state requires liability coverage for damages caused to another driver's property and bodily injury. The state requires that uninsured and sub-insured motorists are covered.

Minimum requirements for bodily injury and property damage include $25,000 per person, and $50,000 per accident. These minimums provide a great starting point. However, you can opt for higher limits and policies that cover all aspects of your insurance.

Compare rates from the top Missouri providers

Compare your options with multiple insurance providers when shopping for auto insurance. This can be accomplished by requesting quotes for several different insurers or by using an online comparison site.

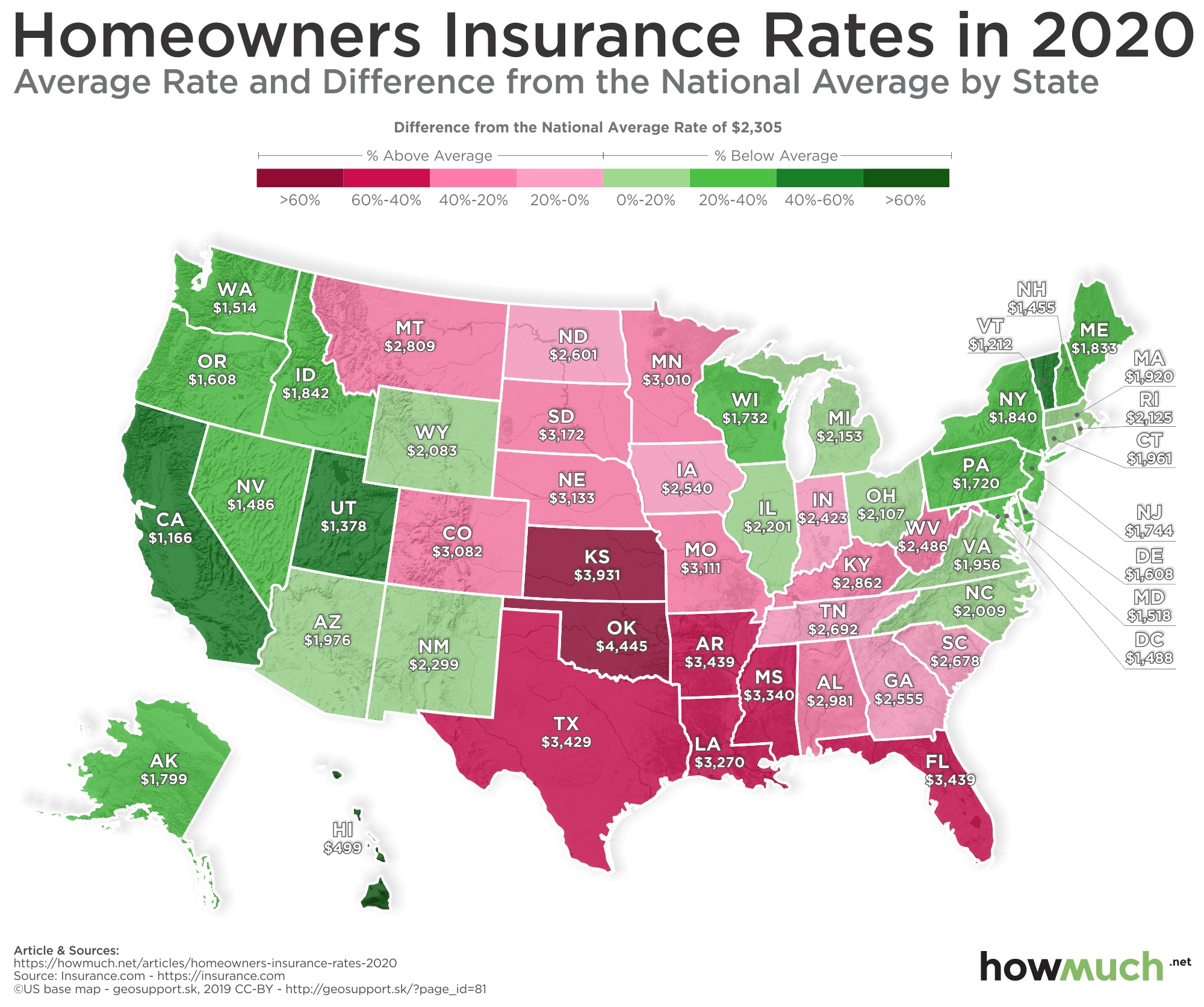

Missouri car insurance rates vary widely between providers and are affected by several factors. The type of car that you drive, the credit score and location are all factors.

Coverage options, such as full or minimum coverage, can have a significant impact on your policy costs. While minimum liability is all you need to meet state laws, full coverage can be a good investment, particularly if you plan on driving a high-value vehicle.

When you are shopping for auto insurance, compare the different types of coverage provided by each company. You can choose from bodily injury, comprehensive, and collision coverage.

Optional coverages such as uninsured and underinsured motorists can be added to your car insurance policy. These are designed to cover the costs of any damages that aren't covered by your basic policy.

Choosing the right policy for your needs is essential to getting a great deal on car insurance in Missouri. You can find a policy that fits your needs and is affordable, regardless of whether you are looking to insure a classic car or only liability.

Your safety and peace-of-mind are dependent on the choice of car insurance you make in Missouri. Online auto insurance shopping and a free online quote will help you get the most coverage.

Your rate for car insurance is influenced by a variety of factors including your credit rating and claim history. Model of your car, as well as your annual mileage, can affect the cost.

Poor credit scores can raise your rates on average by 62%. Some carriers will offer discounts to people with poor credit.

Married and single drivers in Missouri pay an average of 10% less for full coverage than a driver who is not married or single. State Farm and USAA are the cheapest insurance companies in Missouri.

The average cost of a full coverage policy in Missouri is $566 annually. This is 5 % more than the average cost in the United States.