It can be challenging to find the best Missouri homeowners' insurance, regardless of whether you are new or a seasoned homeowner. You need to find an insurance company that provides the coverage you want at a price that you can afford. You have to be aware that there are many things to look for when comparing companies and quotes.

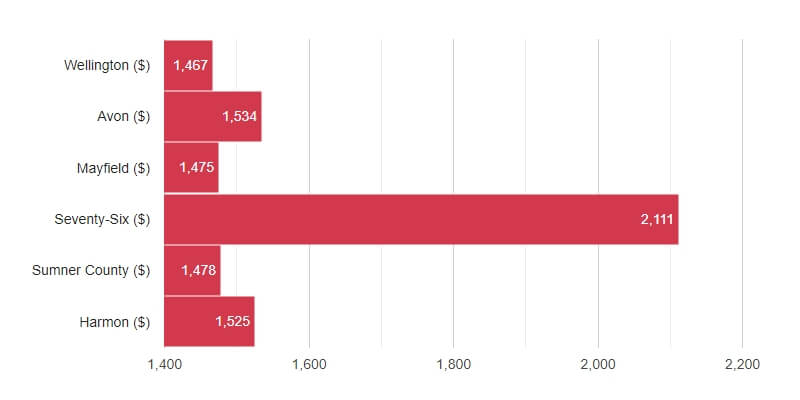

Average Home Insurance Rates in Missouri

Missouri homeowners' insurance costs are $2,876 on average per year. This is higher than average. It doesn't necessarily mean that there aren't ways to reduce your rates.

What you live in can impact your home insurance rates

Insurance rates for homes located in high-risk areas can be increased. On the other hand, if you're in a rural area or live outside of the tornado belt, you could see lower homeowners insurance rates.

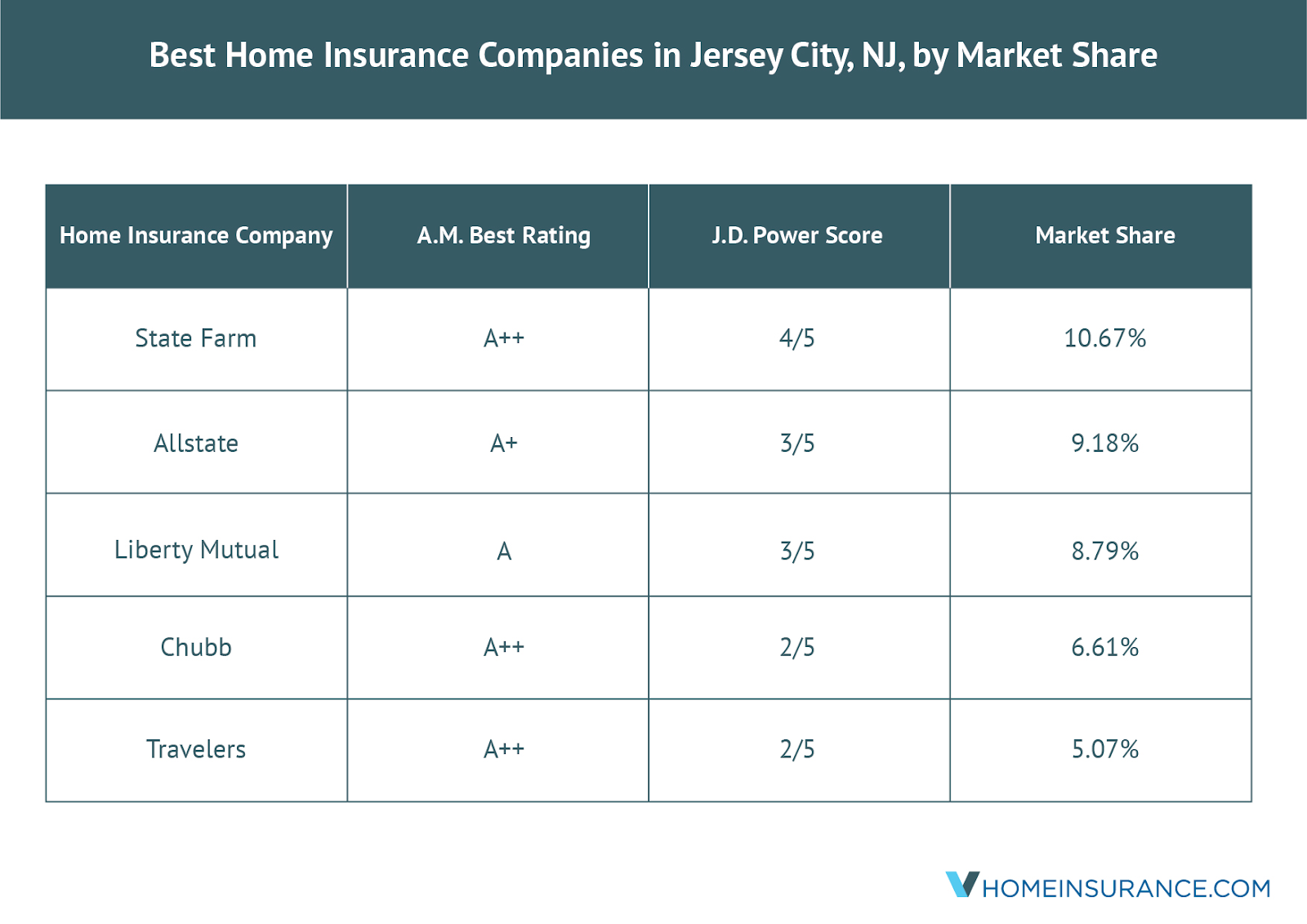

What are the top home owners insurance companies in Missouri?

Allstate, Farmers and State Farm are some of the top Missouri homeowners insurance providers. Each company offers different discounts and protection levels, so you should compare them.

Best Home Insurance in Missouri for Current and Retired Military Members

USAA provides a good homeowners insurance policy for current and retired members of the military. Their customer satisfaction rating is 882 out 1,000 which is the best among home insurance providers.

GEICO Missouri offers a quality home insurance program. Their policy is 40 percent cheaper than average for the state, and they offer both home and auto coverage.

They've got a 3.07 complaint index from the NAIC, which means they receive three times as many complaints as the average company.

Allstate's customer service is excellent, but its home insurance costs are not the lowest in Missouri. Its average annual cost is $896. That's 40% less than what the state average is.

Many Missouri Insurance Companies Offer Bundling Option

Look for companies offering multiple policies such as home and auto insurance under the same roof. This will save you money on your monthly bills, and make it more likely for you to stay with that company.

For more information you can ask your insurance agent, but it is also worth visiting the company website. Some sites give you a quick summary of what the insurance company charges, offers and how simple it is to make a claim.

The value of a house and its age are also factors that can affect the cost of insurance. Select a policy which provides adequate coverage for your house and its contents.

Flood insurance should be purchased if your home is in a high-risk area. Generally, flood insurance is not included as part of home insurance. However, it can be purchased independently.