Arizona homeowners' insurance covers your home, personal possessions and other assets against a range of perils. Included are fire, natural disasters such as earthquakes, and theft. The insurance also covers you if there is a claim for injury or damage caused to another's property.

USAA is the company that offers the lowest homeowners insurance rates in Arizona. Its average annual rates for a house worth $400K are $1216, which is equivalent to $134 per month.

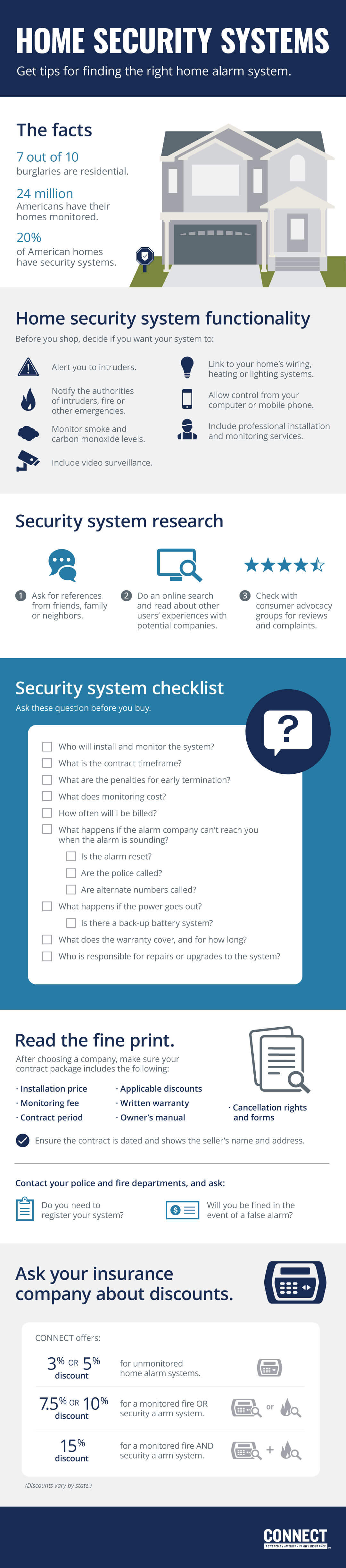

Before choosing a home insurance company in Arizona, it is important to compare several. Some have better customer service, while others offer more flexibility in how you use your coverage. Some offer discounts if you install certain features, such as security cameras.

Review your policy at least once a year.

Every year, you should review your homeowner's insurance to make sure that it is adequate for the risks you may face. Your agent should be informed of any changes made to the home or landscaping, such as renovations, sprinklers, sheds and pools.

Ask your agent about the deductible.

The higher your deductible, the less you'll pay in premiums. In the case of a kitchen fire, for example, your $1,000 deductible will pay for contractors to fix the damage, while the insurer covers the remainder.

Consider also purchasing replacement costs coverage. Your items will be replaced for a reasonable cost. This is especially true if the items you own are expensive, such as jewelry, electronics, or other valuables.

You'll likely need homeowners insurance if you are considering a mortgage. It's a good idea to have homeowners insurance even if you do not have a mortgage.

Check with your local independent insurance agent to get an accurate quote on the best home insurance in AZ for you. Compare policies and find out about discounts available to reduce your homeowners insurance cost.

You should also shop around to find the right coverage if you are planning to relocate. As the risk of disasters or weather damage is higher in your new neighborhood, it is important to compare home insurance quotes to protect yourself and your investment.

It is also smart to assess your rebuilding costs. Arizona is prone to severe damage caused by wind, hail and monsoons rains.

Mercury can help protect your property and understand the dangers that come with living in your area, whether you're in Phoenix, Tucson or Scottsdale. You can get a free inspection of your home from your local Mercury agent to make sure you are aware of any risks.

Are you searching for a house to purchase in Arizona?

When moving to Arizona, you should make sure you get the right homeowners' insurance. With the proper insurance, you can save yourself thousands of pounds in the future.

Are you worried about the cost of your home insurance?