Kansas homeowners insurance costs are affected by many factors. To ensure you have the right coverage, it is important to know the different types of home insurance available. Kansas's severe weather, credit scores, and your zip code can all impact the price of your homeowners insurance.

You can save money by looking for insurance companies that offer discounts or special features to help you save on your home insurance. Insurance policies for home include protection for your house and personal effects, as well liability protection. Your policy may cover damage caused by wind, hail, and other natural disasters. You can also choose to pay a higher deductible if you would like to lower your rate.

Allstate offers many different home insurance policies. The standard HO-3 policy covers all perils unless otherwise specified in your policy. An HO-8 plan, which covers 10 different perils, is another option. In addition, you can opt to add windstorm coverage. Windstorms are the most dangerous dangers in the tornado belt. You may need to have a separate windstorm policy if your area is at risk.

Kansas averages $2461 per annum for home insurance. This is the second highest rate in the country, after Oklahoma. The rates may vary depending on where you live. Gardner, Kansas has some of the best home insurance rates.

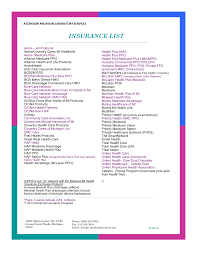

Insurify makes it simple to compare quotes from different carriers. They have helped thousands get the coverage that they needed at an affordable cost. SelectQuote offers another way to quickly compare quotes. The online tool allows you to quickly get a quote on Kansas home insurance.

Marysville Mutual is a great choice if you are looking for homeowners insurance in Kansas. They are not the biggest but have a strong reputation. As such, they are able to provide excellent service. Despite their lack of many agents, the NAIC has a relatively low complaint rate.

It is important to be ready for extreme weather in the fall and winter. Kansas homeowners are also at risk from hail and storms. Storm shutters can be installed to help reduce the severity of severe storms. Storm-proof roofs can be installed to prevent a home being damaged by severe weather.

If you live in a city, it is important to check with your local agent to see whether your city is in the FEMA National Flood Insurance Program. You can buy flood insurance, which will cover flooding. Add sewage backup, earthquake coverage to the policy.

The choice of the right insurance provider can make a big difference in the cost of your homeowners' insurance. It is best to shop around at least once a year to find the best rate.